Belton auto title loans are a popular, quick financial solution secured by your vehicle's equity, offering lump-sum cash with competitive rates and flexible terms. They have straightforward eligibility and approval processes. However, they come with stricter collateral requirements compared to Belton personal loans, which offer more versatility in purpose, repayment terms, and interest rates but may require no-credit checks and could be less accessible for urgent needs due to longer approval times.

In the financial landscape of Belton, Texas, understanding your loan options is crucial. This article delves into two prominent choices: Belton Auto Title Loans and Personal Loan Options. We provide a comprehensive overview of Belton auto title loans, exploring their mechanics and benefits. Additionally, we navigate diverse personal loan paths, highlighting advantages and disadvantages in a side-by-side comparison. By the end, readers will be equipped to make informed decisions tailored to their unique financial needs.

- Understanding Belton Auto Title Loans: A Comprehensive Overview

- Personal Loan Options: Exploring Diverse Financial Paths

- Comparing Advantages and Disadvantages: Belton Auto Title Loans vs Personal Loans

Understanding Belton Auto Title Loans: A Comprehensive Overview

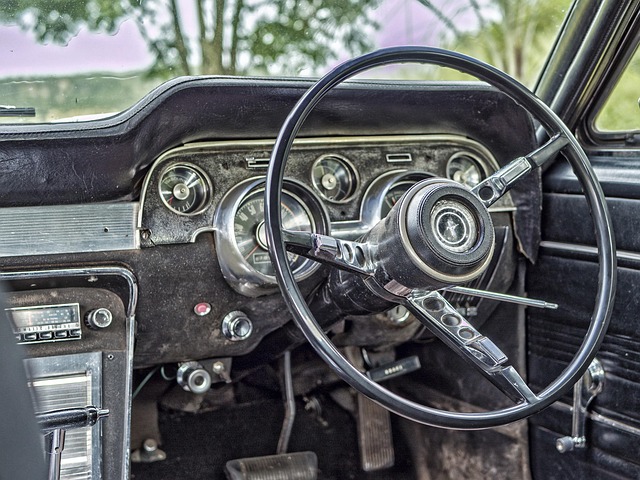

Belton auto title loans have emerged as a popular choice for individuals seeking quick financial assistance. This type of loan is secured by the value of your vehicle, offering several advantages to borrowers. When you opt for a Belton auto title loan, the lender provides you with a lump sum based on your car’s equity, allowing you to access immediate funds. One significant benefit is that these loans often come with flexible repayment terms and competitive interest rates compared to traditional personal loans.

The process is straightforward; you simply need to provide proof of vehicle ownership and valid identification. Once approved, the lender will facilitate a direct deposit of the loan amount into your bank account, ensuring swift access to financial resources. Additionally, Belton auto title loans offer the option of loan extensions if unexpected circumstances arise, providing borrowers with greater flexibility. This alternative lending solution can be particularly beneficial for those who need rapid financial support without the stringent requirements often associated with traditional banking options.

Personal Loan Options: Exploring Diverse Financial Paths

Personal Loan Options offer a diverse array of financial paths for individuals seeking funding. Unlike Belton Auto Title Loans, which use a borrower’s vehicle as collateral, personal loans are a broader category that includes various types tailored to different needs. These options often come with competitive Interest Rates and flexible repayment terms, making them accessible to a wide range of borrowers. For instance, some lenders offer direct deposit, eliminating the need for lengthy application processes and providing faster access to funds.

This versatility is particularly beneficial for those with good or fair credit who might qualify for lower rates. Moreover, many personal loan providers do not conduct a no credit check evaluation, appealing to borrowers with limited credit history. By exploring these options, individuals in Belton can find suitable financial solutions that align with their unique circumstances, offering a more comprehensive and potentially less restrictive approach to meeting their monetary requirements.

Comparing Advantages and Disadvantages: Belton Auto Title Loans vs Personal Loans

When considering Belton auto title loans versus personal loan options, it’s crucial to weigh the advantages and disadvantages of each. One significant perk of Belton auto title loans is that they often offer faster approval times compared to traditional personal loans. This can be particularly beneficial if you need funds quickly for an emergency or unexpected expense. Moreover, these loans typically have simpler eligibility requirements, as they are secured by your vehicle, potentially making them accessible to a broader range of borrowers.

On the other hand, personal loans usually come with more flexibility in terms of use. You can borrow money for virtually any purpose, including home improvements, education, or even emergency funds. Additionally, personal loans often offer more diverse repayment plans and interest rates, allowing borrowers to find options that fit their financial comfort levels. While vehicle inspection is required for auto title loans to assess your car’s value, personal loans may not have such stringent collateral requirements.

When considering your financial options in Belton, it’s clear that both Belton auto title loans and personal loans offer unique advantages. While auto title loans provide quick access to cash with fewer stringent requirements, personal loans often come with lower interest rates and more flexible terms. The best choice depends on your individual circumstances and needs. Carefully evaluating the pros and cons of each will help you make an informed decision that best suits your financial situation.