Belton auto title loans offer fast cash secured by your car's title, providing flexibility and swiftness for urgent needs but carries risks like repossession and high-interest rates if payments are missed, especially challenging for unpredictable incomes. These loans may not suit everyone without stable income or significant vehicle equity.

In the financial landscape of Belton, Texas, Belton auto title loans have emerged as a unique borrowing option. This article delves into the intricacies of these loans, providing a comprehensive overview for borrowers. Understanding Belton auto title loans involves grasping their basic mechanics and exploring both the advantages and drawbacks. By examining the pros and cons, you’ll be better equipped to navigate this alternative financing method, making informed decisions in light of your financial needs.

- Understanding Belton Auto Title Loans: The Basics

- Pros: Unlocking Benefits for Borrowers

- Cons: Potential Pitfalls and Risks to Know

Understanding Belton Auto Title Loans: The Basics

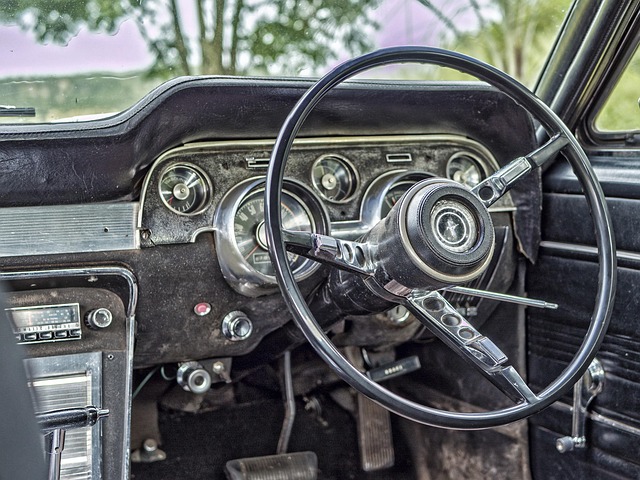

Belton auto title loans are a financial solution where individuals can use their vehicle’s title as collateral to secure a loan. This type of lending is designed for those who need fast access to cash, offering a straightforward and potentially quicker alternative to traditional bank loans. The process involves applying with a lender who assesses the value of your vehicle and provides funding based on that evaluation. One key aspect is that you retain possession of your vehicle during the loan period, hence the term keep your vehicle loans.

Unlike other secured loans, Belton auto title loans allow borrowers to maintain their daily transportation while they repay the debt. Repayment options typically include structured monthly payments, with flexible terms depending on the lender and the value of the vehicle. While this can be beneficial for those in need of immediate funds, it’s crucial to consider the potential drawbacks, such as interest rates and the risk of default leading to vehicle repossession.

Pros: Unlocking Benefits for Borrowers

Belton auto title loans offer a unique financial solution for individuals seeking quick access to capital. One of the primary advantages is the benefits they provide to borrowers. These loans, secured by the value of your vehicle, can unlock several advantages. For instance, repayment options are tailored to suit individual needs, allowing borrowers to choose plans that fit their budget and timeline. This flexibility ensures that even if you’re facing financial challenges, you can maintain control over your finances while repaying the loan.

Additionally, the process is swift and efficient compared to traditional loan methods. With a car title loan, you can secure funding in a shorter time, enabling you to address urgent financial needs promptly. This aspect is particularly beneficial for those in Belton looking to capitalize on opportunities or cover unexpected expenses without long waits. The convenience of these loans makes them an attractive option for many, providing a safety net during times of financial strain.

Cons: Potential Pitfalls and Risks to Know

When considering Belton auto title loans, it’s crucial to understand the potential pitfalls and risks associated with this type of lending. One significant con is the risk of defaulting on the loan, which can lead to repossession of your vehicle. If you’re unable to make payments as agreed, the lender has the right to seize your car, causing financial strain and potentially leaving you without a means of transportation.

Another notable downside is that these loans often come with high-interest rates and strict repayment terms. Unlike traditional loans that might offer more flexible repayment options, Belton auto title loans typically require structured payments over a shorter period. This can make it challenging for borrowers with unpredictable income or unexpected financial emergencies, as missing even one payment could trigger severe consequences, including additional fees and penalties. Moreover, these loans may not be suitable for everyone, especially those without a stable income or significant vehicle equity.

Belton auto title loans can provide a quick solution for borrowers in need of cash, but it’s crucial to weigh both the pros and cons before making a decision. By understanding the benefits, such as access to funds and flexible repayment terms, alongside potential risks like high-interest rates and the risk of vehicle repossession, individuals can make an informed choice that aligns with their financial needs. When considering Belton auto title loans, a thorough assessment ensures you unlock the benefits while avoiding pitfalls.