Belton auto title loans offer quick cash for vehicle owners with minimal paperwork and fast approval. Ideal for those with limited credit history or unexpected expenses, these loans use vehicle equity as collateral with competitive rates and flexible terms. However, they carry substantial risks of high-interest rates and debt traps if not managed carefully.

“Considering a Belton auto title loan? This comprehensive guide explores when such loans are suitable for your financial needs. Discover the ins and outs of Belton auto title loans, from their basic understanding to who qualifies. Weigh the benefits and risks involved to make an informed decision. By the end, you’ll know if this option aligns with your financial goals, offering a clear path forward for managing unexpected expenses.”

- Understanding Belton Auto Title Loans

- Who Qualifies for Belton Auto Title Loans?

- Benefits and Risks: Weighing Your Options

Understanding Belton Auto Title Loans

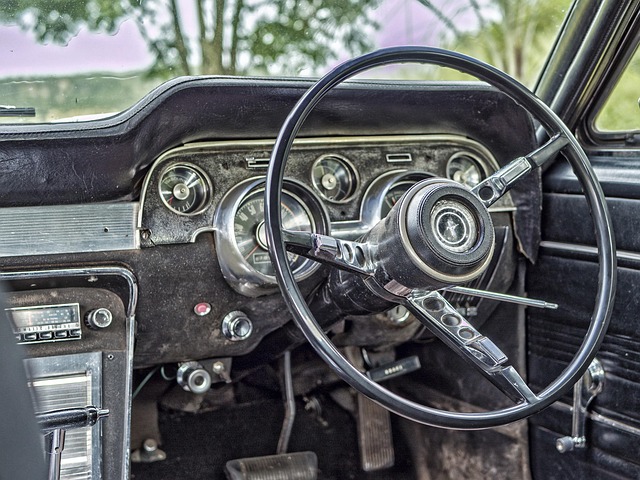

Belton Auto Title Loans are a financial solution where individuals can use their vehicle’s equity as collateral to secure a loan. This type of lending is designed for those who own a car, truck, or motorcycle and need access to cash quickly. The process involves using your vehicle’s title as security, allowing lenders to offer competitive interest rates and flexible repayment terms. It’s an attractive option for Belton residents who may not have perfect credit or require funds for unforeseen expenses.

Unlike traditional loans that rely heavily on credit scores, Belton auto title loans assess the value of your vehicle, ensuring a faster approval process. This is particularly beneficial for individuals seeking Dallas Title Loans or those with limited credit history. Whether it’s to cover unexpected medical bills, home repairs, or even starting a small business, these loans provide a safety net by leveraging your vehicle’s equity. For those in need of quick funding and owning a motor vehicle, exploring Belton auto title loans could be a strategic financial move, possibly even more accessible than Truck Title Loans in certain cases.

Who Qualifies for Belton Auto Title Loans?

Belton auto title loans are a financial solution designed for individuals who own a vehicle and need access to quick cash. To qualify for this type of loan, borrowers must meet certain criteria. Typically, applicants should be at least 18 years old, have a valid driver’s license, and hold clear legal ownership of a vehicle with significant equity. The vehicle serves as collateral, ensuring the lender’s investment.

The Belton auto title loans process involves providing detailed information about the vehicle, including its make, model, year, and condition. Lenders will then assess the value of the vehicle to determine the maximum loan amount offered. Unlike traditional loans, these titles loans often boast a quick approval process, allowing borrowers to access their funds in as little as 30 minutes after providing necessary documents and finalizing the agreement. Additionally, those with existing loans may consider refinancing their Belton auto title loans to secure better terms and rates.

Benefits and Risks: Weighing Your Options

Belton auto title loans can offer a quick solution for individuals needing immediate financial aid. One of the significant advantages is accessibility; unlike traditional bank loans, these loans often don’t require a credit check, making them available to more people. This feature is particularly beneficial for those with poor credit or no credit history, providing an alternative when other loan options may be limited. Additionally, the process is typically swift, ensuring fast cash in hands within a short time frame.

However, it’s crucial to consider the risks associated with such loans. Belton auto title loans often come with high-interest rates, and if you’re unable to repay on time, it can lead to significant financial strain. Furthermore, loan refinancing options might be limited, trapping borrowers in a cycle of debt. It’s essential to weigh these factors carefully before deciding, ensuring you understand the terms and conditions to make an informed decision about using Belton auto title loans as a financial tool.

Belton auto title loans can be a viable option for those in need of quick cash, but it’s crucial to understand both the benefits and risks before proceeding. If you’re comfortable with the terms and feel it aligns with your financial situation, these loans can provide a helpful bridge during times of need. Always remember to weigh your options and consider alternative sources of funding when available.